image.png

image.png

Bitcoin helps you save yourself from the slow-mo collapse of the banking system in the U.S.

What mathematically cannot continue will not continue. Always trust math.

This article is a verbatim reprint from a Twitter thread started by Jack Mallers. For historical context, two major banks had failed in the last few hours, and Bitcoin — instead of plummeting like other risk assets — decided to skyrocket 15% instead.

We're watching the banking system of the United States collapse on itself in real-time. The Federal Reserve may have broken the US banking system and tarnished its credibility.

Are we entering a new era for US banking? Will the world now truly appreciate Satoshi and #Bitcoin?

In 2008, bank portfolios were riddled with bad credit. Same problem this time? Nope. This time bank portfolios are riddled with long duration bonds like US Treasuries and Mortgage Backed Securities.

Wait... what? We were told those were "risk-free"? What's the problem?

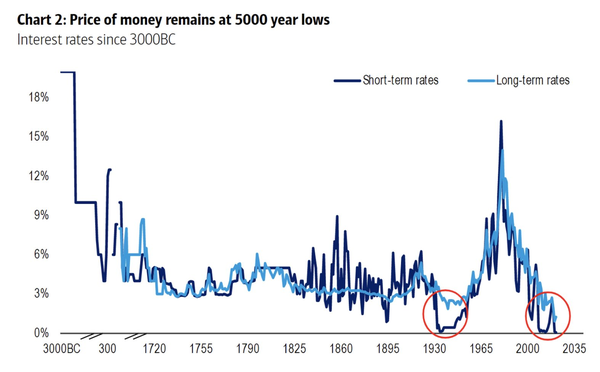

In 2020 the Fed began the great COVID-monetary-expansion at the lowest interest rates in 5,000 years. Free access to unlimited money for all. The result? Huge rise in deposits & loans for banks.

What did banks do with all the cash? Risk-free long duration bonds! Right, Jerome?

Unfortunately, there are major consequences when you allow the cost of money to be zero. What consequences, exactly? Inflation. Inflation of everything you want to buy with that money.

By 2022 we had record inflation numbers in the US. 20%+ annual inflation if you wanted to live in a house. Uh oh!

The Fed had a massive problem. Their unlimited money printing forced banks to take on unlimited deposits + loans & hold long duration bonds. But the American people had had enough. Their USD was getting destroyed by record inflation. It all started to look like Zimbabwe. 20%+ annual inflation if I wanted a house?! I thought this was America?

The Fed had to fix this and fix it fast. How fast? The fastest Fed rate hike cycle ever, to be exact. Never before had we seen the Fed raise interest rates this much and this quickly. Unfortunately, that has consequences too. Who would've thought?

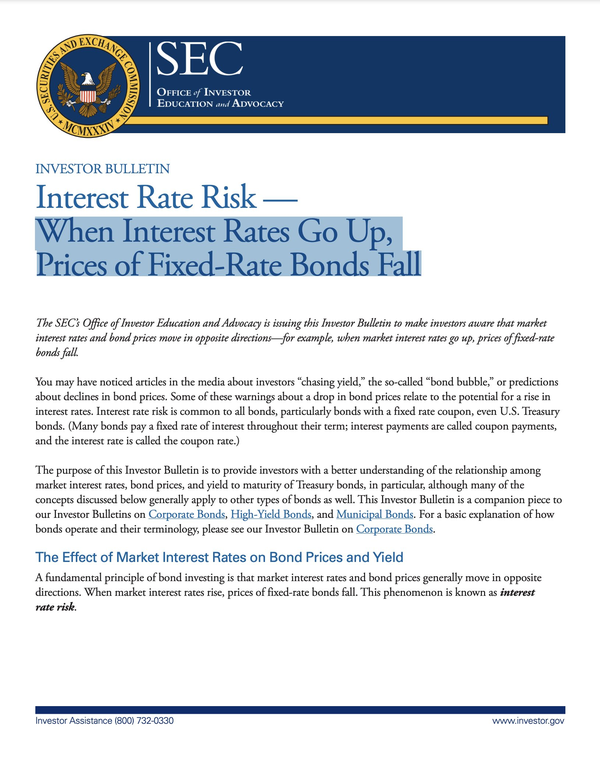

"When Interest Rates Go Up, Prices of Fixed-Rate Bonds Fall" Don't take my word for it, I'm a stupid millennial Bitcoiner. Take the SEC's word for it.

Man, whoever is holding these fixed-rate bonds is screwed! Wait, who is holding a lot of those again? Banks. Yes, your bank too. All banks are losing money right now. They're not losing their own money by the way, they're losing your money.

I'll dumb it down: Your bank took your money and bought these bond things. Because the Fed has to fix the near-hyper-inflation they caused, the stuff your bank bought with your money is falling fast. The Fed broke banks and the banks no longer have your money.

Do you understand?

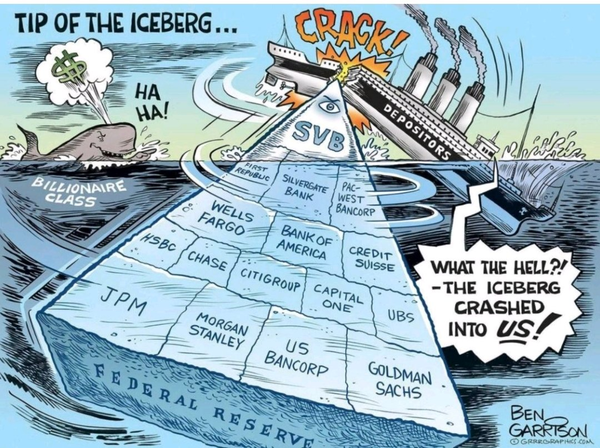

By the way, this isn't just about Silicon Valley Bank. This is about the entire U.S. banking system. Every small to midsized bank has this exact same issue.

History doesn't repeat, but it sure does rhyme. In 2008, the first to drop was Bear Sterns. Did they get bailed out? Yes. Did government allow big banks to get involved? Yes. Did that fix everything? No. JP Morgan bailed out Bear Sterns. Six months later Lehman went down.

SVB = Bear Sterns? Who will be Lehman? Who knows!

The Fed drove banks into record deposits + loans and then crushed fixed-income assets at record pace. Their irresponsible monetary policy has driven the US banking system into extreme insolvency. Any trust the Fed had is now gone. Now, the Fed is busted with nowhere to run. They were unable to revert inflation before the US banking system blew up in their face. Soon, they will have to allow for infinite U.S. dollars to be created to ensure the banks have the money the American people think they do.

All the new funding of U.S. dollars required for banks will cause more record inflation. The Fed will have to admit they aren't actually in control, they can't tame inflation, and the value of the dollar is uncertain at best, unsafe at worst. Their reputation may never recover.

What do the markets do now? Punish the Fed for their mistakes and protect themselves. Tonight every portfolio manager is now thinking about their U.S. dollar exit strategy. Confidence in the dollar and the banking system is shot. Liquidity will flee banks. Risk assets will soar.

#Bitcoin fixes this. This was Satoshi's innovation. #Bitcoin is the only instrument in history with an absolute fixed supply and incorruptible monetary policy. You cannot inflate it. You cannot change it. You don't need to trust it. America can truly appreciate #Bitcoin now.